SSAS PROPERTY CHATBOT REPORT:

Welcome to the Segmented Solutions SSAS Property Chatbot 2024:

Before we begin we must stress that none of the information within the hundreds of different SSAS Property Reports is to be taken as personal or business advice. (That it comes later!). But we do hope the information presented will be food for thought and prompt you to consider the best way forwards in your SSAS & Property journey.

NOW TOTALLY FREE!

This amazing SSAS Property Chatbot was being sold for £97 + VAT – which was a massive discount on the true value of the HUNDREDS of detailed technical reports that are contained within it. (Each has a value of over £1,500)

But as we offer FREE training and support, we felt it was time to give this amazing SSAS Chatbot away for FREE to anyone who seriously wants to explore their property purchase options.

(There is no catch – honest!)

CHATBOT INTRODUCTION:

I have been delivering specialist technical training and tax advice support for the clients of Financial Advisors, Accountants and Solicitors for over 35 years now. During that time I have been involved in the pensions field as an Examiner for the Chartered Insurance Institute as well as writing all of the technical and ‘compliance’ manuals for at least 2 major life offices.

Owning and running a SSAS Provider and dealing with HMRC directly has also added to the knowledge that I have put into this chatbot. Alongside my own knowledge, I have brought the wisdom of anti-avoidance experts, VAT directors and SDLT lawyers to sit alongside my own network of specialist pensions tax practitioners.

This chatbot is therefore the culmination of more than just my lifetime of intensive learning and experience – it draws together the wisdom of advanced level experts and advisors who do not need to ‘promote’ themselves – as they are the ‘go to’ in each of their own fields.

The idea behind the chatbot is a simple one:

1) Ask a series of questions to determine what you want to do in relation to property – ignoring all the rules.

2) Present a lengthy report explaining how to put your plans into play – using SSAS money and specific exemptions rather than ‘opinions’.

This SSAS Property Chatbot covers the following:

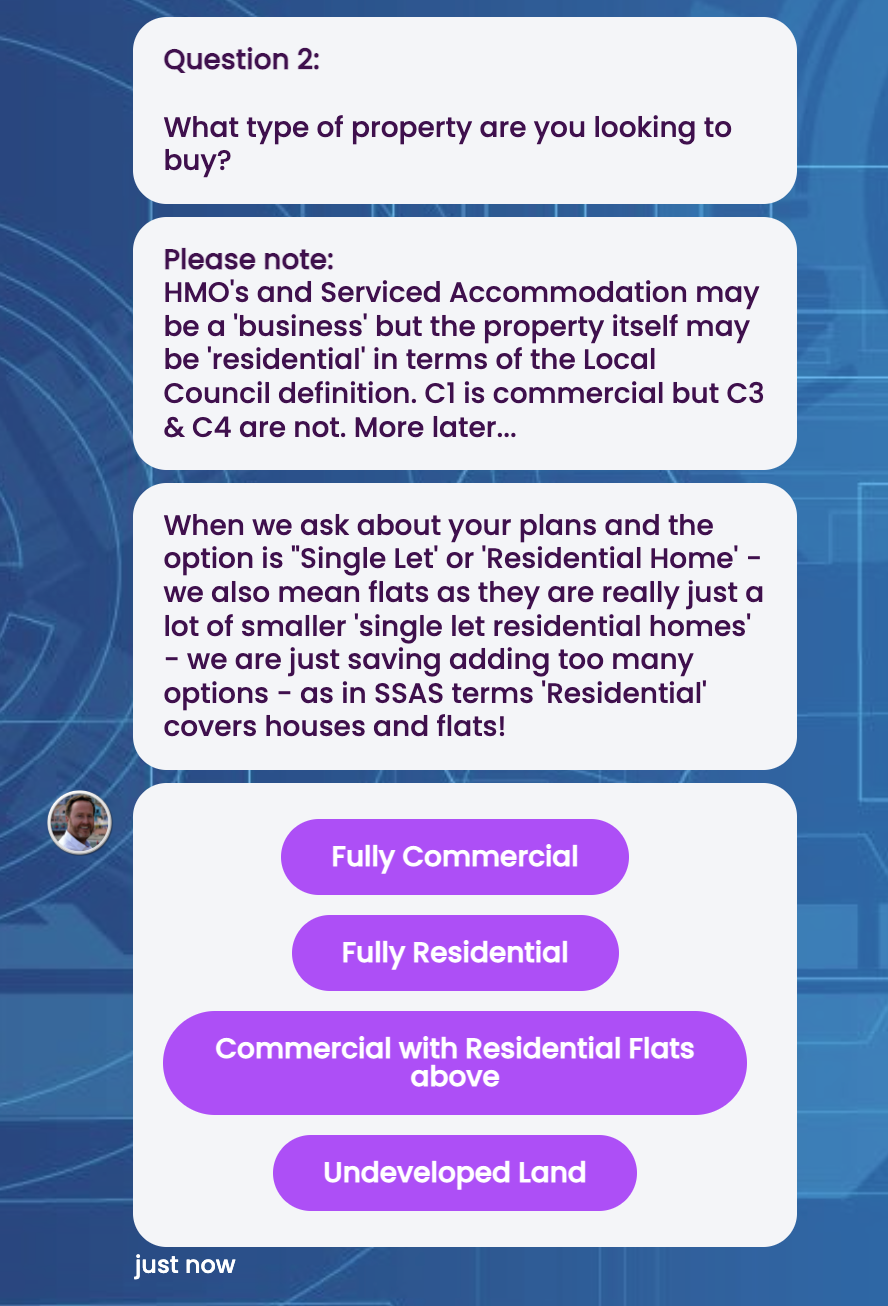

Residential vs Commercial vs Mixed Use vs Land.

Pensions Act Exemptions.

Real Estate Investment Trusts.

Genuinely Diverse Commercial Vehicles.

SDLT Exemptions and Refunds.

SSAS VAT Planning and special VAT Exemptions.

SSAS and Sponsoring Employer Conveyancing.

SSAS Establishment – FREE video link

Advanced Property Planning using GDCVs & REITs – FREE video link

However the reality is that no mater how complex we made this chatbot, there will always be scenarios that are slightly out of the norm.

As you can use the SSAS Property Chatbot for as many scenarios as you want – you are actually getting over 168 full length professional SSAS Property Tax Reports.

There is no other place on the internet where ALL this information is available in the one place…. There is no expiry date – so even if your plans take time to come to fruition, the SSAS Property Chatbot will be there waiting for you 24/7.

The Report pages are updated in real time – so if something is amended or added, then you will get immediate and unlimited updates

The reason why this Chatbot is so important is because there are a lot of NEW HMRC reporting questions being asked for all SSAS investments made from 6th April 2023… many of which may trip up the unwary SSAS Administrator.

We HIGHLY recommend watching the video below, as it explains why:

IMPORTANT CHATBOT LICENSE NOTES:

If you want to buy a commercial property with flats above (a typical mixed-use scenario), it might be worthwhile going through both the residential and the commercial chatbot reports. Also your plans may change and you may want to know how a different and new plan will alter the report.

Because life does chop and change – we thought that you would want to have a License to use the chatbot for as many different scenarios as you could ever need. So you will be getting access to hundreds of slightly different reports – all with specialist notes for your own use.

Please remember – this is a Chatbot and not ‘formal tax advice’!